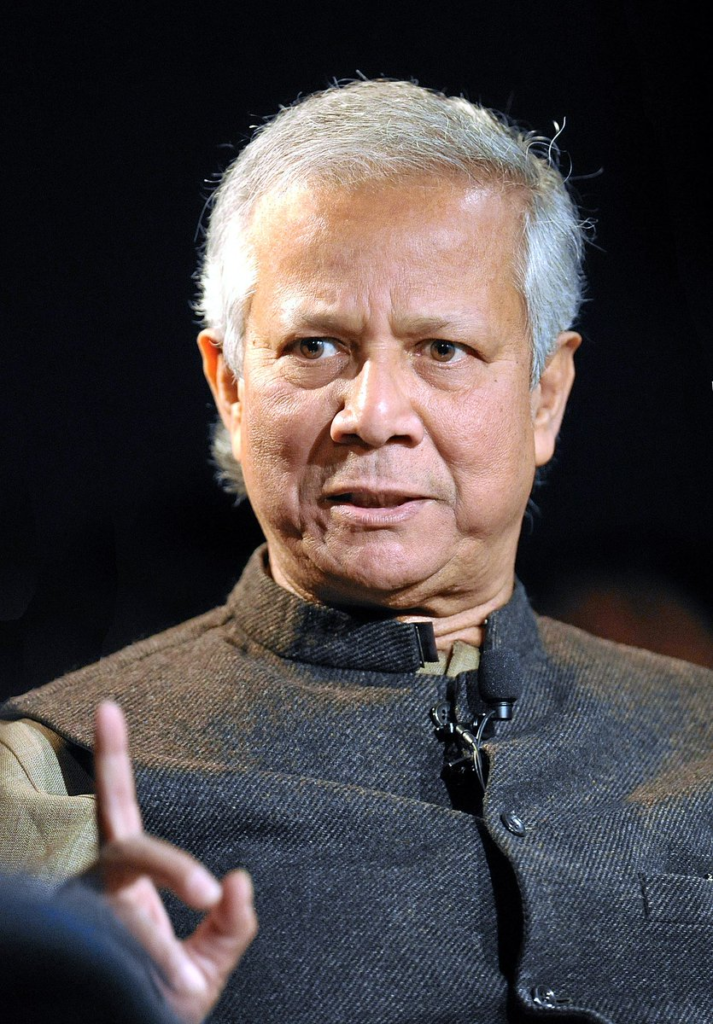

In a surprising turn of events, Nobel Prize winner Muhammad Yunus, renowned as the ‘Banker to the Poor,’ has been sentenced to six months in jail by a Bangladesh court for violating labor laws. Yunus, credited with pioneering microfinance loans to uplift impoverished communities, received bail pending appeal.

The 83-year-old’s relationship with Bangladesh’s Prime Minister Sheikh Hasina, marked by tensions and accusations, adds a political dimension to the case. Yunus, who once contemplated forming a political party, faced scrutiny from Hasina’s government after her return to power in 2009. Accusations ranged from using force to recover loans to violating government regulations.

The recent verdict targets Yunus’ company, Grameen Telecom, holding it guilty of labor law violations. The court sentenced Yunus, serving as chairman, and three other directors to six months in jail. Grameen Telecom, a non-profit founded by Yunus, owns a significant stake in Bangladesh’s largest mobile phone company, Grameenphone.

Yunus is entangled in over 150 cases, including allegations of tax evasion and unauthorized receipt of funds. The mounting legal challenges have prompted global concern, with 160 international figures, including Barack Obama and Ban Ki-moon, denouncing the “continuous judicial harassment” in a joint letter last year.

Hasina, responding to international criticism, welcomed experts to assess the legal proceedings against Yunus. Former Amnesty International head Irene Khan labeled Yunus’s conviction a “travesty of justice.” Despite the turmoil, Yunus, granted bail during the appeals process, remains a symbol of social and economic development through initiatives like Grameen Bank, which has lifted millions from poverty by disbursing collateral-free loans.

The case against Yunus reflects a complex interplay of politics and legal challenges, raising questions about the future of microfinance and social entrepreneurship in Bangladesh.

Be First to Comment