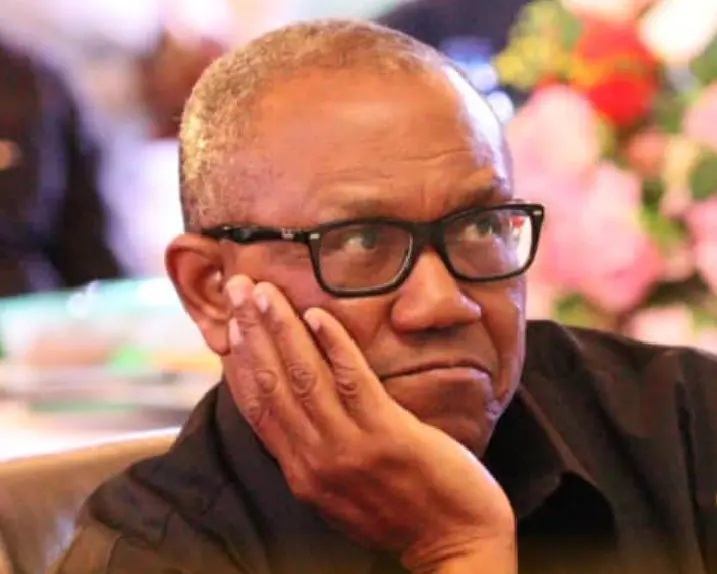

Peter Obi, the presidential candidate of the Labour Party in the 2023 elections, has provided insights into the reasons behind the shutdown of foreign businesses in Nigeria. He attributed this trend to what he referred to as a negative medium to long-term prospects strategy, an unattractive investment profile, and a persistently deteriorating business environment, among other factors.

Expressing his concern, Obi called on government officials at all levels in Nigeria to take immediate measures to reverse this trend and retain strategic international investors. He made these remarks in response to the reported departure of Procter & Gamble (P&G), a multinational consumer goods company, from Nigeria.

LEADERSHIP reports that P&G had announced a limited market portfolio restructuring that includes pulling out of Nigerian and Argentinian markets.

Reacting to the report in a series of posts on social media on Thursday, the former Anambra State governor highlighted reasons why Nigeria scares away multinational companies, explaining that with the purchasing power of most Nigerians nose-diving everyday, absence of the rule of law and lack of a conducive business environment, it will be difficult to retain such “iconic companies” and talk more of attracting new ones.

Obi wrote: “A few months ago, I lamented the exit of one of the top global Pharmaceutical giants, GlaxoSmithKline (GSK) from Nigeria. GSK remains a top global pharmaceutical manufacturer and has had 51 years of operations in Nigeria.

“The reason for their exit was that there was no longer a perceived growth in Nigeria anchored on productivity. Today, Procter & Gamble (P&G), the world’s largest personnel care and household products company, makers of iconic brands like Pampers, Gillette, etc, is again leaving Nigeria, for the same reason GSK left.

“Following this also are French pharmaceutical company Sanofi-Aventis, and top Energy firm, Norwegian behemoth Equinor which has sold off its Nigerian business development associates Fifteen years ago, P&G, as they are commonly called, viewed Nigeria as a strategic country of importance and invested millions of dollars in an ultra-modern chain supply structure in Agbara which, sadly, is now up for sale. The presence of these iconic companies in any economy is not only that they signify trust and confidence, as well as belief in the medium to long-term socio-economic prospects of such countries, but they massively create jobs, invest in Research and Development, as well as pieces of training which smaller players in the industry learn from and adapt. They help, to a great extent to develop local talents for both local and global jobs. The exit of these top global companies shows that our medium to long-term prospects strategy is in the negative. Our investment profile is not attractive and our business environment is deteriorating continually.

“The purchasing power of most Nigerians is nose-diving every day. In the face of the absence of the rule of law, and a conducive business environment, it will be difficult to retain such iconic companies and talk more about attracting new ones.”

He, therefore, urged the government to take immediate steps to ensure that institutions of governance are put in place and actively engaging to show that the situation is reversed.

He added that, “National greatness and development cannot be pursued in an atmosphere that is scaring away strategic international investors.”

Be First to Comment