In a groundbreaking deal, BlackRock, the world’s largest asset management company, is set to acquire Global Infrastructure Partners (GIP), a company founded by Nigerian investment banker Adebayo Ogunlesi, for a whopping $12.5 billion. The acquisition involves a $3 billion cash payment and the issuance of approximately 12 million BlackRock shares, positioning Ogunlesi and five other co-founders of GIP as the second-largest shareholders in the global asset management giant.

This strategic move aligns with BlackRock’s vision, led by Chairman and CEO Laurence Fink, to transform the firm into a major player in the growing market for private and alternative assets. The combined business, valued at over $150 billion, aims to deliver market-leading infrastructure expertise across equity, debt, and solutions at a substantial scale.

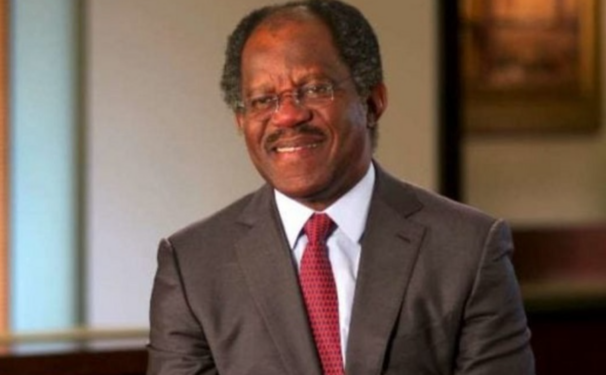

Adebayo Ogunlesi, renowned for his success in the financial and infrastructure sectors, will not only continue to lead GIP as Chairman and CEO but will also join BlackRock’s board following the completion of the deal.

GIP’s notable assets include Gatwick Airport, London City Airport, Port of Brisbane, Port of Melbourne, Sydney Airport, and various green energy holdings. Ogunlesi’s impressive track record includes overseeing the acquisition of Gatwick Airport, which raised his profile in Nigeria.

This acquisition solidifies BlackRock’s position as the second-largest private investor and manager of infrastructure globally, with the company currently managing a massive $10 trillion worth of alternative assets.

The deal is expected to be finalized in Q3 2024, marking BlackRock’s most significant transaction since acquiring Barclays Global Investors in 2009. The move is driven by the increasing need for new infrastructure in areas such as digital infrastructure, logistics hubs, and decarbonization, coupled with high government deficits.

Adebayo Ogunlesi, an alumnus of Oxford University and Harvard Business School, has been a key player in the finance industry. His journey includes 23 years at Credit Suisse, where he rose to the position of Executive Vice Chairman and Chief Client Officer of the Investment Banking Division. The sale of GIP is expected to further elevate Ogunlesi’s influence as he joins BlackRock’s board and global executive committee.

Be First to Comment