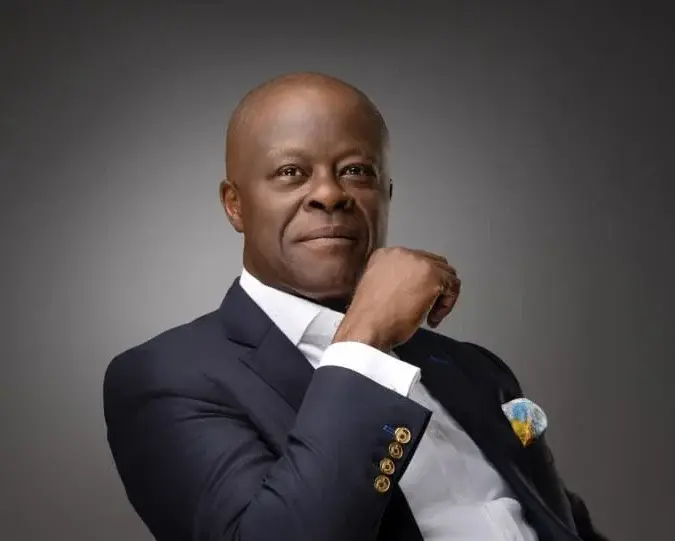

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has announced that government-owned enterprises, ministries, departments, and agencies (MDAs) remitted a total of ₦835.70 billion in revenue to the federal government in February.

This amount represents a significant increase of ₦681.45 billion or 441.78% compared to the ₦154.25 billion remitted by MDAs during the same period in 2022.

Speaking at a presentation titled “Reconstructing the Economy for Growth, Investment, and Climate Resilience Development” at the Lagos Business School Breakfast Club, Edun highlighted the impact of automation in enhancing revenue remittance. Since January 2, 2024, the government has implemented an automated process that sweeps 50% of MDAs and government-owned enterprises (GOEs) internally generated revenue twice daily, resulting in higher remittance figures.

“There is a notable increase in revenue contributions from MDAs and GOEs, rising from ₦154.25 billion in February 2023 to ₦835.70 billion in February 2024 due to the automated two-times daily sweep of 50% of MDAs and GOEs IGR since January 2, 2024,” he explained.

In December 2023, the Federal Government, through the Ministry of Finance, directed all MDAs to remit 100% of their internally generated revenue to the Sub-Recurrent Account, a sub-component of the Consolidated Revenue Fund.

The government stated in a circular that the directive was to improve revenue generation, fiscal discipline, accountability, and transparency in the management of government financial resources and prevent waste and inefficiencies.

“All Ministries, Departments, and Agencies that are fully funded through the annual Federal Government budget (receiving personnel, overhead, and capital allocation) and on the schedule of the Fiscal Responsibility Act, 2007 and any addition by the Federal Ministry of Finance should remit 100 per cent of their internally generated revenue to the Sub-Recurrent Account, which is a sub-component of the Consolidated Revenue Fund,” the circular read.

The finance minister emphasised that augmenting revenues was a crucial aspect of a comprehensive execution strategy aimed at achieving a 78 per cent year-on-year rise in budgeted revenue for 2024.

He underscored the importance of implementing an upgraded government revenue assurance model, adding that the target was to reduce the budget deficit from 6.1 per cent of GDP in 2023 to 3.9 per cent.

“We have set out a robust execution plan for a 78 per cent y-o-y increase in budgeted revenue in 2024, but implementing enhanced the government’s revenue assurance model is critical with a target budget deficit of 3.9 per cent of GDP from 6.1 per cent in 2023.”

Edun underscored the government’s strategy of increasing the pricing of government securities, which had successfully attracted dollar inflows but at a higher cost to the government.

He further stated that the government had revamped the process for the commencement of 2024 capital expenditure payments by MDAs and GOEs through direct payments to contractors and employed prudent measures to minimise redundancy and reduce leakages through digitisation.

He said, “We have taken prudent expenditure measures by minimising unnecessary redundancy, reducing leakages through digitisation and eliminating inefficiencies. There is also a revamped process for the commencement of 2024 capital expenditure payments for MDAs and GOEs, which is through direct payments to contractors while promoting a government-wide cost curtailment culture across all MDAs & GOEs.”

Be First to Comment