The Federal Government has utilized about N4.83 trillion from Nigerian Treasury Bills (NTBs) and Bonds issued in 2024 to settle its debt owed to the Central Bank of Nigeria (CBN), known as Ways and Means Advances.

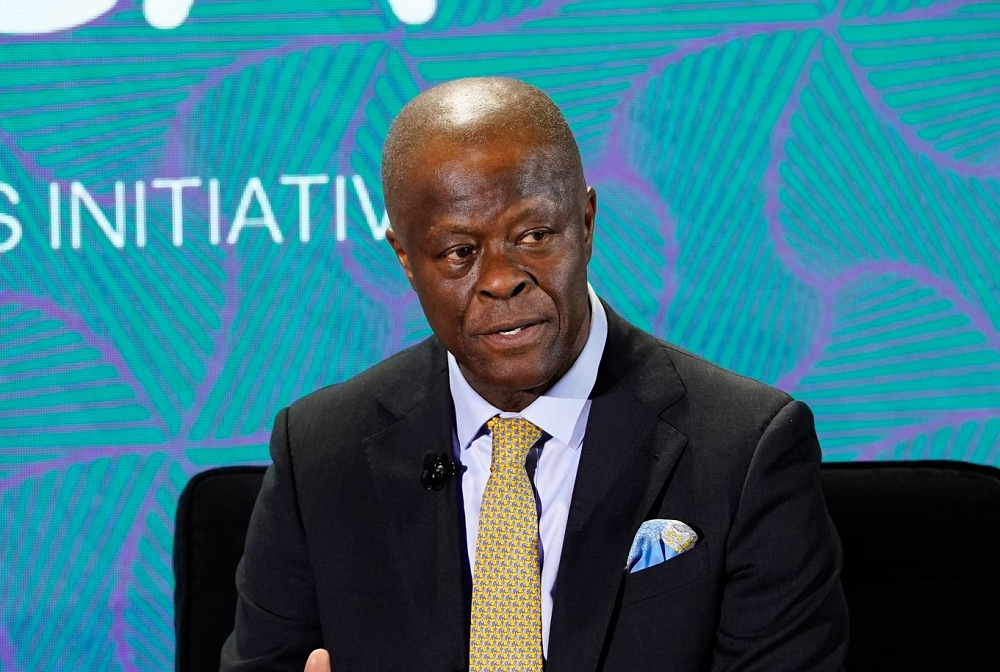

This information was disclosed by the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, during a presentation at the Lagos Business School (LBS) Breakfast Club.

Debt Cycle and Management

The Federal Government’s approach to managing debt appears cyclic, involving borrowing to meet existing debt obligations. Previously in late 2023, the government borrowed N2.94 trillion from the CBN through Ways and Means Advances to service domestic debts.

Now, the government is using funds raised from public domestic debt through NTBs and Bonds to repay this significant loan from the CBN. This cycle raises concerns about the sustainability of the government’s fiscal strategy, impacting investor confidence and Nigeria’s credit rating.

Government’s Debt Management Strategy

Edun highlighted the government’s strategy of increasing the pricing of government securities to attract dollar inflows, albeit at a higher cost. Data reveals a notable increase in the volume and discount price of 364-Day NTBs, indicating growing investor interest and government efforts to foster economic growth.

CBN’s Role and Investor Interest

The CBN’s strong stance to defend the naira has resulted in substantial interest payouts, with foreign investors showing significant interest in Nigerian financial instruments. Higher interest rates aim to control inflation and attract foreign investment, stabilizing the Naira but limiting the central bank’s flexibility in other areas.

Insights into Ways and Means and Debt Securitization

The Ways and Means provision allows short-term financing from the CBN to address cash flow gaps. Notably, the National Assembly approved the securitization of N22.7 trillion from CBN advances to the government, transferring this debt to the Debt Management Office (DMO) with favorable terms.

The government’s debt management involves a complex interplay of borrowing, debt servicing, and strategic use of public debt instruments to stabilize the economy and attract investment while grappling with fiscal challenges.

In a noteworthy decision with profound implications for Nigeria’s fiscal landscape, the National Assembly also endorsed a substantial increase in the “Ways and Means” ceiling.

According to Section 38 of the CBN Act, 2007, the apex bank may grant temporary advances to the Federal Government about temporary deficiency of budget revenue at such rate of interest as the bank may determine.

The Act placed a limit of five per cent on how much the Federal Government could borrow, although the previous administration severely violated the limit.

The National Assembly introducedamendments to the CBN Act, elevating the ceiling of Ways and Means Advances from the apex bank from five to 15% of the Federal Government’s previous year’s revenue.

This endeavour to raise the limit to 15% opens the door to more borrowing and an increased burden of debt service obligations for the country’s future generations.

However, it is noteworthy that the federal government surpassed this set limit in 2023, exceeding the permissible amount it can borrow from the CBN despite the earlier statementof the current finance minister, Wale Edun, that Tinubu would adhere to the statutory limit.

Despite this breach, the Senate of the 10th assembly, mirroring its predecessor in the ninth assembly, approvedthe securitisation of the outstanding N7.3 trillion in Ways and Means.

Be First to Comment