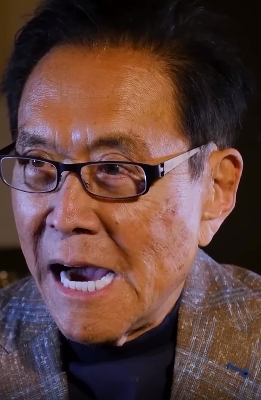

Renowned personal finance author and entrepreneur Robert Kiyosaki, famed for ‘Rich Dad, Poor Dad,’ recently opened up about being in debt surpassing $1.2 billion. In a candid Instagram reel, Kiyosaki shared his unique debt philosophy, emphasizing the distinction between assets and liabilities.

According to Kiyosaki, while many people use debt to acquire liabilities, he strategically uses it to purchase assets. He illustrated this with examples, stating that his luxury vehicles, including a Ferrari and a Rolls Royce, are considered liabilities and are fully paid off.

In a bold move away from conventional financial wisdom, Kiyosaki expressed skepticism about saving cash, citing the US dollar’s detachment from the gold standard in 1971. Instead of saving in cash, he disclosed his preference for storing wealth in gold and converting earnings into silver and gold, which has contributed to his substantial $1.2 billion debt.

Kiyosaki nonchalantly remarked, “If I go bust, the bank goes bust. Not my problem.” During a podcast, he further delved into his debt strategy, differentiating between good and bad debt. He attributed his wealth generation to good debt, such as loans used to acquire income-generating assets, particularly in real estate.

The 76-year-old financial guru urged people to view debt as leverage in investments, endorsing the concept of using it wisely to build wealth. Kiyosaki’s unconventional financial philosophy extends to his advocacy for investing in ‘real assets’ like Bitcoin, gold, silver, and even Wagyu cattle. Bitcoin, in particular, is highlighted as a hedge against the diminishing value of the US dollar.

Despite his staggering $1.2 billion debt, Kiyosaki remains confident in his financial strategy, challenging traditional norms and promoting a unique approach to wealth creation.

Be First to Comment